As candle makers, we somehow play with magic. From raw materials, we shape scented products to ease our souls. However, there are things that in our candle-making industry cannot be tackled with magic, like pricing your product. The topic of today’s post is inspired by one of our readers, she has an adorable candle shop in the UK, and she asked us: “how do I price my candles?”.

The most common way to price a candle is to calculate the costs associated with producing a batch (wax, materials, packaging costs and shipping fees) and divide the amount by the number of candles in the batch. Then, multiply the result of the division by three or four to obtain a market price.

We will explore why this common way is so common and, most notably, how you can create a better pricing system by thinking about the product in terms of costs and customer benefits.

Let’s dive into it!

Candle Pricing: from Costs to Customer Benefits

Why is cost-based pricing so typical? Because it’s the easiest to calculate and implement in your processes. Somehow being the most used, it feels like it’s the best model to determine how much our candles are worth it.

That’s the misconception we want to tackle with this post. You can use your cost-based pricing as a benchmark along with a couple more models that we will identify, such as competitor-based pricing and the most exciting value-based pricing.

Don’t get us wrong: cost-based pricing is important and lets you enter the market along with plenty of others candle makers with microscopic price variance from each other. But it at least lets you survive: if it’s adequately calculated by selling the whole batch of candles, you will make a positive profit.

To summarise, the most common formula is:

Candle Price = (Costs per Candle) * 3.5

To calculate Costs per Candle you have to sum up all the costs you have incurred for producing a batch of candles (i.e. 20? 50? 100?), including materials, packaging and a rough idea of shipping fees and divide the total amount for the number of candles in the batch.

In this post, we highlight all the numbers and necessary math to make your candle-making business profitable, and I suggest reading it out properly to understand how to calculate an excellent cost-based price.

Hypothetically speaking, by doing the calculation above, we found out that our price for a candle is 17$ per jar. Great – now we know that we are going to make a profit with that model.

It’s time to add a new dimension now; check the market price of similar products within our same niche, and see how our competitors are performing.

The model we want to add to our cost-based pricing is competitor-based pricing, which will help us assess whether our candles fit our target market. We have to explore the market segments and its players, our competitors.

With this model, we won’t have to calculate anything. Instead, we have to dive deep into data and list how our chosen competitors sell similar products.

You can use a similar table:

| Competitor | Product | Price |

|---|---|---|

| Name A | 200g Jar Beewax | 22$ |

| Name A | 200g Jar Organic | 24.90$ |

| Name B | 200g Jar Organic | 27$ |

| Name C | 200g Jar Organic | 29.90$ |

With such a simple table, you can grasp where your product is positioned and whether it’s cheaper, similar or more expensive than your competitors’ products but also whether you are moving towards the mass market (3-10$ ) or towards the premium/luxury market (>25$).

After this analysis and drawing some insights from our research, we can retouch the cost-based price figure because we believe that our product has a different impact from our competition. Maybe because you create your essential oils, give a personalised touch or anything else that makes it unique.

We are missing one last step now. If you read our Business & Marketing category of posts, you know how the most important entity to consider: is CUSTOMERS!

Consider that most candle maker businesses focus on cost-based pricing only without even thinking about the missing piece, what customers enjoy and value the product themselves.

Value-based pricing is the differentiator for your business because it will guarantee that the price isn’t just a label but it will be part of the whole creative process.

Value-based pricing will surprise you; sometimes, we undervalue our creations. By sticking to the math evidence followed by strict cost-based pricing, we freeze ourselves in a specific market segment without even thinking about “maybe my creations are worth more or differently from what my spreadsheet tells me”.

Let’s explore value-based pricing in more depth.

How to Price a Candle with Value-based Pricing

Value-based pricing forces us to do the most challenging thing: talk to our prospects and existing clients. We want to create a weekly routine in which we interact, reach out, and simply listen to their thoughts, feedback, and critiques.

As you can guess, I’m stretching this model a bit because you have to get into the habit of acquiring customer data and insights before using the model – if not, it will be dissonant and not as valuable.

Before starting this process, maybe it’s worth reading this post where we go through some crucial steps to get used to.

Now, consider that you are in a position where you have a customer channel in place, meaning that you actively communicate with some of your most active customers and even prospects.

Now, you can ask the Dutch economist, Van Westendorp, for some help!

He will help us understand the price sensitivity that your customers have towards your products.

Pricing Candles with Van Westendorp

People aren’t very good at thinking about specific price points: would you be able to tell if a particular product is worth $99/m or $79/m? It’s not as easy as it seems because most of the worth is filtered by our psychological price sensitivity to certain products.

Around 1976, however, Van Westendorp introduced his model to help understand and derive value-based pricing. The best part is that it only relies on four questions that you can ask your customers and prospects.

The questions are as follows, and you might want to tweak them a bit but keep the essence in place:

- At what price would you consider the product to be so expensive that you would not consider buying it? (Too expensive)

- At what price would you consider the product starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it? (Expensive/High Side)

- At what price would you consider the product to be priced so low that you would feel the quality couldn’t be very good? (Too cheap)

- At what price would you consider the product to be a bargain—a great buy for the money? (Cheap/Good Value)

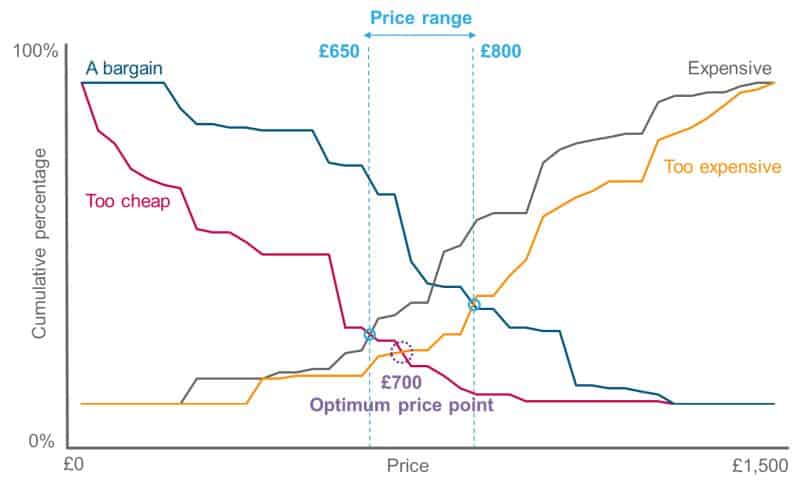

When you reach a good number of responses (30+, but the more, the better), plot the cumulative answers and gain insights by looking at how the distributions move and intersect. We found this post that helps you with math using a simple spreadsheet to come up with a similar graph like the one below.

Let’s analyse it, though. When the Too Cheap line intersects the Expensive line, we have our lower range price. When the Cheap but Good Value crosses the Too Expensive line, we have our upper bound of the price range.

Once we have identified a price range, we would know that if we pick a price that is below the price lower bound of the range, our customers won’t perceive our product as good, and if it’s greater than the upper bound, they won’t buy it because they will think that isn’t worth as much.

Ultimate Price Formula

We have analysed all three methods: cost-based, competitor-based, and value-based pricing.

That’s all we need to come up with a pricing that checks these three boxes:

- it’s cost-effective (selling the candle makes us profit)

- fits the market (it’s in the market segment we decided to play among our competitors)

- it’s valued by your customers

The last part of the formula, as in any procedure, is testing.

I would pick some values out of the price range and test them towards the market. Then, you could sell some online for a price and others for a bit more price in a pop-up shop.

Track and collect your figures to ask yourself questions like how many did I sell at what price? In how much time? With what gross profit?

Do all this process that seems quite tedious for around 90 days. After that, you will have a winner price tag for your candles.

But it’s not all that. By finding the price tag, you have in place a system that can be easily expanded, with more batches, premium packaging and so on…the wax is the limit!